Among the most frequently asked questions that figure on most people s minds when it comes to borrowing an fha loan pertain to fha appraisals and the minimum qualifying criteria for the roof of the borrower s home.

Fha roof certification letter.

The condition of the roof is important as it s a major source of headaches for a home owner if there is a problem down the line.

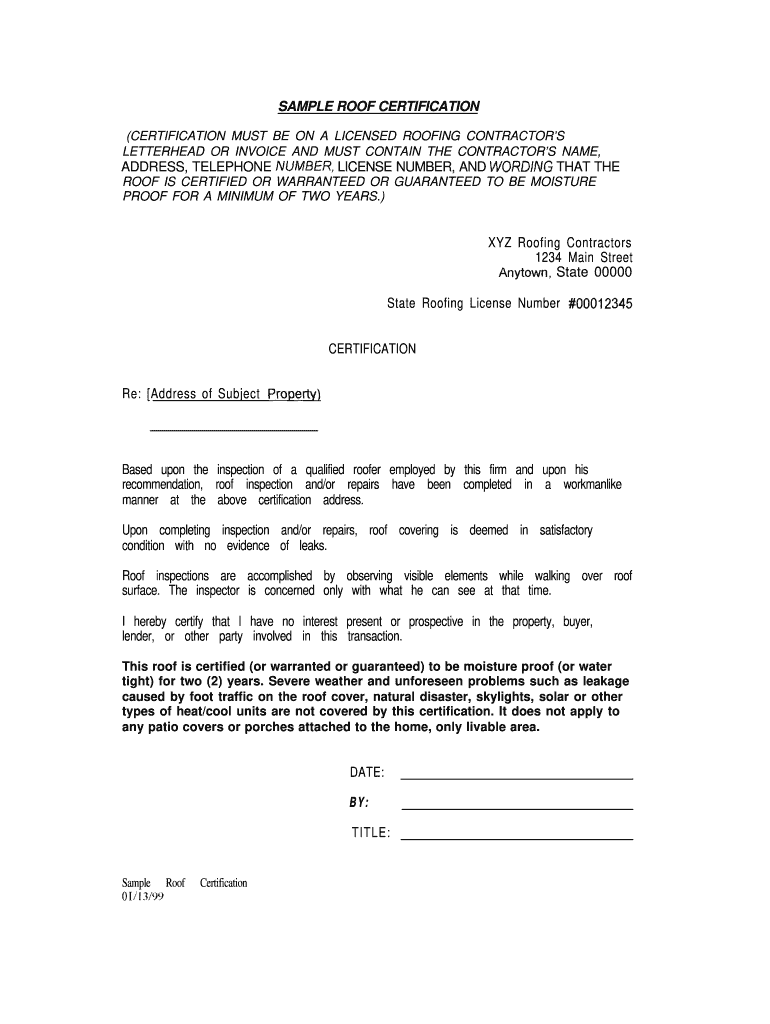

Many sellers are advised to provide a roof certification to the buyer as part of the sales process.

If it has that many layers certification is likely out of reach unless the whole roof is replaced.

A federal housing administration loan or fha loan has very similar requirements to the va loan.

Roof certifications give buyers peace of mind.

In order to pass the appraisal process the roof must also provide reasonable future utility durability and economy of maintenance according to the fha official site.

As with the va loan an fha loan requires that the roof on a home not be leaking.

Appraisal requirements for fha mortgage loans are found in hud 40001 and include guidelines for electrical systems plumbing paint and also requirements for the roof.

If sellers refuse to provide a roof certification and the roof is older home buyers might decide to pay for their own inspection and make it a contingency of the sales contract.